Social security is not my subject. I’m not even entitled to receive it in old age, so my knowledge is non-existent.

What I do know, however, is that there cannot possibly be any welfare (in its broadest sense) without a nation-state. And there can’t be a nation-state without clearly defined, non-porous borders and all of the other attributes of the nation-state. I started talking about it on this blog over a decade ago. Since then, all of my predictions have come true.

You can’t be simultaneously pro-open borders and pro-welfare. Open borders mean a dramatic impoverishment and lumpenization for the overwhelming majority. There cannot be a middle class without the nation-state. We are seeing the erosion of the middle-class everywhere where these policies have been adopted. Dramatic cuts to public education, public healthcare, policing, infrastructure. Austerity in everything. That’s the price for the dismantling of the nation-state. Welcome to the new neoliberal reality.

We are seeing the erosion of the middle-class everywhere where these policies have been adopted.

And still, not just in America, but around the world, we are seeing lots of middle-class people – especially white liberal women – voting precisely for the politicians who will implement such measures.

LikeLiked by 1 person

All politicians have been implementing and will continue implementing these measures. Whatever they say during their campaigns, once they are elected, they all do the same. And we never hold them to account, so whose fault is it in the end?

LikeLike

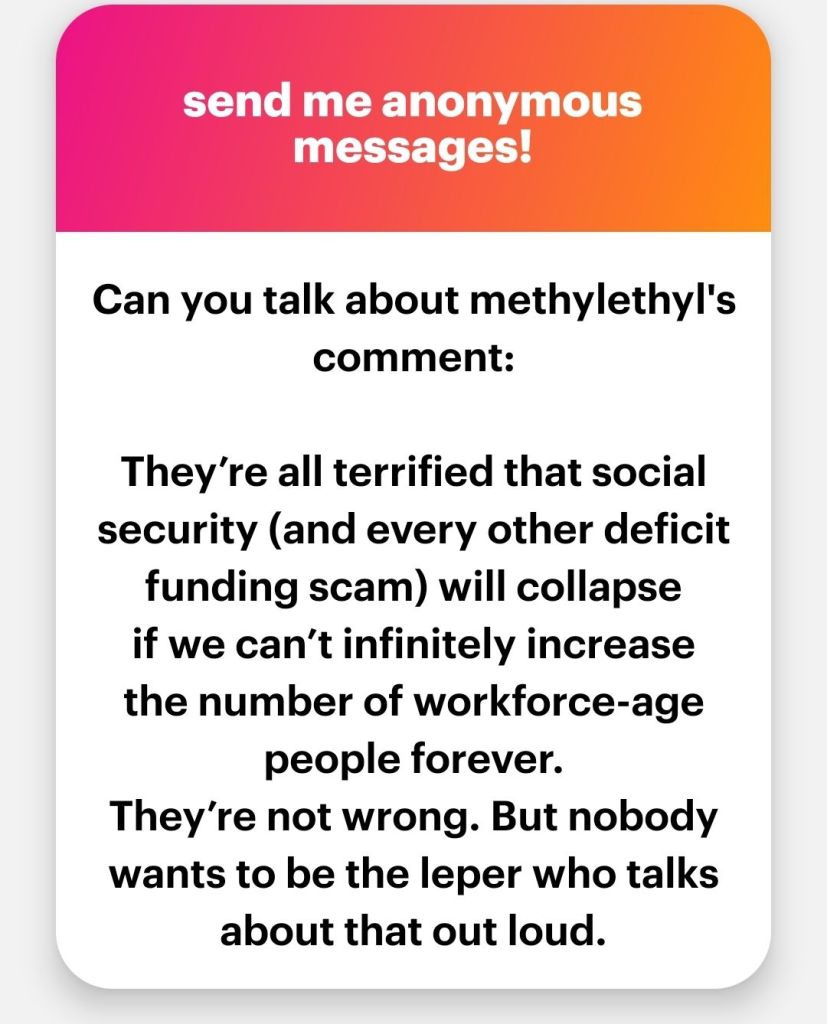

All sorts of government programs that are funded by deficit spending– but Social Security is the clearest model of this, as it was *designed* that way– were designed on the (boomer-era) premise that the population, and the economy, would expand forever. The social security taxes that working Americans pay *right now* don’t go in a fund for them when they’re old. They get paid out directly to people currently collecting social security, many of whom draw more in entitlements than they ever paid in. This works as long as there are always more people paying into the system, than drawing from it.

So for example, the most current numbers I could find say the average social security recipient, is drawing a little over $22k/yr. Which is a pittance, if you’ve got no other income, and hard to live on. But a worker making a median income in America of $80k is paying 12.4 percent. If you’re self-employed, you pay all of this directly, but if employed in a 1040-form (as opposed to 1099) kind of way, then what you see on your pay stub is only half: 6.2% (your employer is paying the other half– you’re still paying it, but that’s money that would’ve been available to raise your wage, if it hadn’t been going to SS taxes). So someone making a median income is paying in just shy of $10k/yr. That means that even before you go into admin costs and stuff, just for normal regular social security entitlements, you have to have more than double the number of people paying into the system, as are collecting from it. Some of this happens naturally: not everyone lives long enough to collect. But half of all people in the US do NOT die before retirement age. Not nearly. Which means that over time, for this system to keep working, you need a constantly expanding workforce paying in. If the population numbers became static, or the number of retirees grew in proportion to the number of people in the workforce (oh, look, there’s the Boomer bulge!) the whole thing would collapse.

How do you solve this problem in a situation where the birthrate has been on a steady downslope for decades, and people are living longer than they used to? You import workers. This *might* even be sustainable longterm, if you imported them for limited terms– a few years– and then shipped them back home after collecting taxes on their wages. It is a metastasizing catastrophe if they will then be added to the pool of those entitled to payouts in the future. It is not physically, biologically, or strategically possible to keep expanding the workforce perpetually in order to fund those currently retired.

Of course, if you were really evil, the other way to solve it would be to drastically reduce the number of old people on the collecting side.

Now back out a little, and realize that every single government program funded by deficit spending (borrowing money from future workers, to fund things right now), also depends on this mechanism: workforces of the future must be continually more numerous, and more productive, to pay for the stuff we’re spending their wages on right now. And they don’t get a say in it.

That’s a perpetual motion machine. It doesn’t actually work.

But you can fake it for a really long time.

Gets ugly when you can’t keep it going anymore though.

LikeLiked by 3 people

Addendum: In addition to the whole pyramid-scheme aspect of it, where we rob workers in the future to pay for stuff now, there’s also the really nasty part where we are robbing everybody RIGHT NOW, in a sneaky, indirect way. Because when the govt. “borrows” money through deficit spending, what they’re effectively doing is increasing the money supply: inflation.

What that means for regular people trying to save money in the bank to say, retire, or buy a house, or pay for college, is that every dollar we have in the bank, even if it’s in an interest-bearing account, is constantly declining in value because of govt. borrowing. We are piling up money to try and buy a house. Every day that money sits in our bank account, it’s being devalued. The number on our statement goes up a wee bit. The cost of everything we need to buy goes up much, much more. Which means we can responsibly save money out of every paycheck for a future emergency or expense, and… when we’re 65 we can take out all that money and go down to our local 7/11 and buy a candy bar with it. Because the value of the money has been stolen.

LikeLiked by 2 people

This is really scary. We are playing a stupid game with rigged rules.

LikeLiked by 2 people

And we will not be able to vote our way out of it, either, because it’s a stupid game that both political parties are complicit in.

All you have to do to lose an election in this country, is say something that sounds like a threat to Social Security entitlements.

I actually like Peru’s solution to this: instead of govt-administered retirement funds, they simply mandate that workers put a certain percentage of every paycheck into a savings account that’s set up so they can’t withdraw money from it until they reach retirement age. It’s a savings account. It belongs to the worker, not the government. If the worker dies before using it, it can be inherited by his heirs.

LikeLiked by 2 people

Methylethyl, my general impression is that not only the government but corporations as well count on infinite growth. Everything will collapse otherwise.

LikeLike

Everything will collapse. There is no otherwise.

Right now, most of what’s going on in politics is a game of everybody trying to avoid being the one left holding the bag.

LikeLike

To clarify: this matters because the collapse is inevitable, but if we admitted this and planned for it, it could/would have been far far less painful. A hardship, not a catastrophe. I suspect the deadline for that sort of action passed us by decades ago.

LikeLike

How would “planning for this collapse” would have looked like? What do you think would be reasonable policies to deal with social security going forward?

-YZ

LikeLike

Hard to know, since it was never tried. Nobody wants to be honest about it.

I’d have liked to see the program’s termination announced twenty or thirty years ago, with some sort of alternate provisions made for everybody who had already paid into it for a long time, and was within, say 15-20 years of collecting or already collecting, and with means testing added on. Then, to everybody else: hey, this program is unsustainable and we need a different plan. I’d love to see a trial of the retirement savings account, but I’d also like to see what else people could come up with, and a totally separate program for what is now SSI disability.

Much like with education: we’re burdened with a system that’s failed, we don’t have a clear path to get from here to something that generally works, and maybe it’s time to just try everything and see what sticks.

LikeLike

Maybe I missed something, but how do your calculations account for the fact that people pay in to the system for 40-50 years? “But half of all people in the US do NOT die before retirement age. Not nearly.’ So half do, and those that don’t start dying off pretty quickly after age 67 (current retirement age). So there is nowhere near a 1:1 relationship between years of pay in and years of pay out as you describe. I can see why a shrinking workforce could be a problem, but not how it requires a constantly expanding workforce.

LikeLike

You’re still thinking of it as a savings account. It’s not. There’s no money stored up anywhere. There’s only what’s coming in now, and it goes directly out. Don’t ask me to make the math line up: some of that is getting bled out in administrative costs, but I don’t have the numbers on how much. How many social security offices are there in your area? How many people work in each one, and how much does it cost each year to keep the lights on and the swivel chairs functioning and the copier in fresh toner? That’s a mystery box.

So it doesn’t matter how many years you pay into the system. It doesn’t just sit there and wait for you to retire. It determines what you’re theoretically entitled to when you reach 65, but where does that money actually come from? People who are still working when you are 65+

LikeLike

Clarissa, why are you not entitled to receive Social Security in your old age?

LikeLike

“why are you not entitled to receive Social Security in your old age?”

Might be related to not being able to work enough years?

SS used to be a simple entitlement program… reach 65 and you qualify for at least the minimum. Rules are much more restrictive now.

LikeLike

We receive pensions through the Illinois state employee system. Which is why I’m saving for retirement myself. Illinois is not likely to be able to meet its ridiculous pension obligations for much longer. Here, if you are a public worker, you can retire at 54, have another full time job and receive large pension payouts at the same time. It’s how the Dems managed to hold the control over the state for so long. It’s simple bribery of state employees with ludicrous, unsustainable payouts. And it’s another reason why tenure lines are dying. Nobody can afford these very expensive workers who show up for a couple of hours a week and are entitled to payouts until they die.

LikeLiked by 2 people

“We receive pensions through the Illinois state employee system”

Pretty sure a state program would be independent of a federal program (like Social Security). I’ve never heard of state law overriding federal law.

So… you might be able to get something from SS (prob not much but maybe something).

Shouldn’t count on it but it might be a nice surprise.

LikeLike

Texas teachers are like this too; the state has their own pension fund and you don’t build up any SS credits while you’re teaching there. This can cause problems if you move out of state and later find that you don’t qualify for either TX pension or SS because of having half your credits in one and half in the other, thus not enough to get anything from either entity.

LikeLike

“Texas teachers are like this too; the state has their own pension fund and you don’t build up any SS credits”

That is incredibly retarded. Sorry, no other word fits?

Why is so much policy in the US so retarded now?

LikeLike

But I’ve worked for fewer years and qualify.

LikeLike

No, it’s not years. It’s Illinois. It’s called SURS. I’m not complaining or anything. I’m simply stating that I don’t have the need to find out specifically about social security.

LikeLike

Thanks for the explanation. I posted at about the same time as you did so I didn’t see your answer.

LikeLiked by 1 person

It’s ok, it’s a weird thing that nobody understands if they are not in the system.

LikeLike

Here’s another stupid feature of the system: when people retire, they get a cash payout for the vacation and sick days they didn’t take. But in a job where you are rarely on campus, you don’t need vacation and sick days. So everybody accumulates large sums as a result. It’s fantastic for people who managed to catch this gravy train. But it’s the very last gravy train. We are simply not hiring because we can’t afford any of this. We are destroying public education in the state because some people were too greedy and stupid to think about the consequences. I’ve been telling everybody in sight for 15 years that this is coming. All I ever got for my efforts were eye rolls and exasperated sighs. And now they open their eyes wide and ask, “But how can we not hire? Have you explained to the administration that our program will die if we don’t hire?”

LikeLiked by 1 person

“But in a job where you are rarely on campus, you don’t need vacation and sick days”

Tell me about. At a department meeting earlier this year they were hectoring us about making sure we fill out our ‘vacation’ sheets… The director even said it was stupid and that set aside vacation time for university instructors is ‘fiction’ but we had to calculate how many days we had coming and fill out forms saying we were ‘on vacation’ then.

Technically we shouldn’t visit campus during that time though I did a bunch of times….

LikeLiked by 1 person

If anyone has a bit of spare time, there are some videos of a US Representative from Arizona who broke a lot of this down in a few excellent videos. He even has graphs and other visual aids to help with the explanations. The topics he covers are what your taxes actually cover, what the debt the government is taking covers, what is being repaid, SS and what is likely to happen, and what the collapse of the birthrate is doing and will do to the counties economic future.

The guys name is David Schweikert, you can find his vids on youtube, I recommend the last three or four. Its quite eye opening they are roughly half an hour long each.

I tried to put in the links to his vids but it wasn’t having it. You can find him on youtube under RepDavidSchweikert, the ones I’d say watch are the last few before congress.

LikeLike